The Great Convergence: Sports Tech M&A, Youth Surge, and Investor Optimism in H1 2025

A comprehensive look at the sports tech industry's pivotal half-year—where money flowed, strategies converged, and the ecosystem became a system, based on teh Drake Star report

A Market in Overdrive

The first half of 2025 has delivered a surge of momentum across the sports tech ecosystem. While the broader economy remains cautiously optimistic, the sports industry is undergoing one of its most transformational periods in recent memory. From billion-dollar mergers and record-breaking financings to a wave of youth sports digitization, the sector is no longer on the sidelines of innovation. It's front and center.

This isn’t just about flashy tech or fandom hype. It’s about the infrastructure of modern sport being redefined: how it's consumed, monetized, organized, and optimized. A recent H1 2025 market report by Drake Star underscores this shift, mapping a vibrant and increasingly interconnected landscape of players—from AI-powered performance platforms to emerging women’s leagues and collectibles marketplaces.

Behind the numbers lie strategic moves by media conglomerates, sovereign funds, former athletes turned investors, and emerging platforms looking to become indispensable to the future of play, performance, and passion.

Let’s break it down.

1. M&A Activity: Big Moves in a Fragmented Landscape

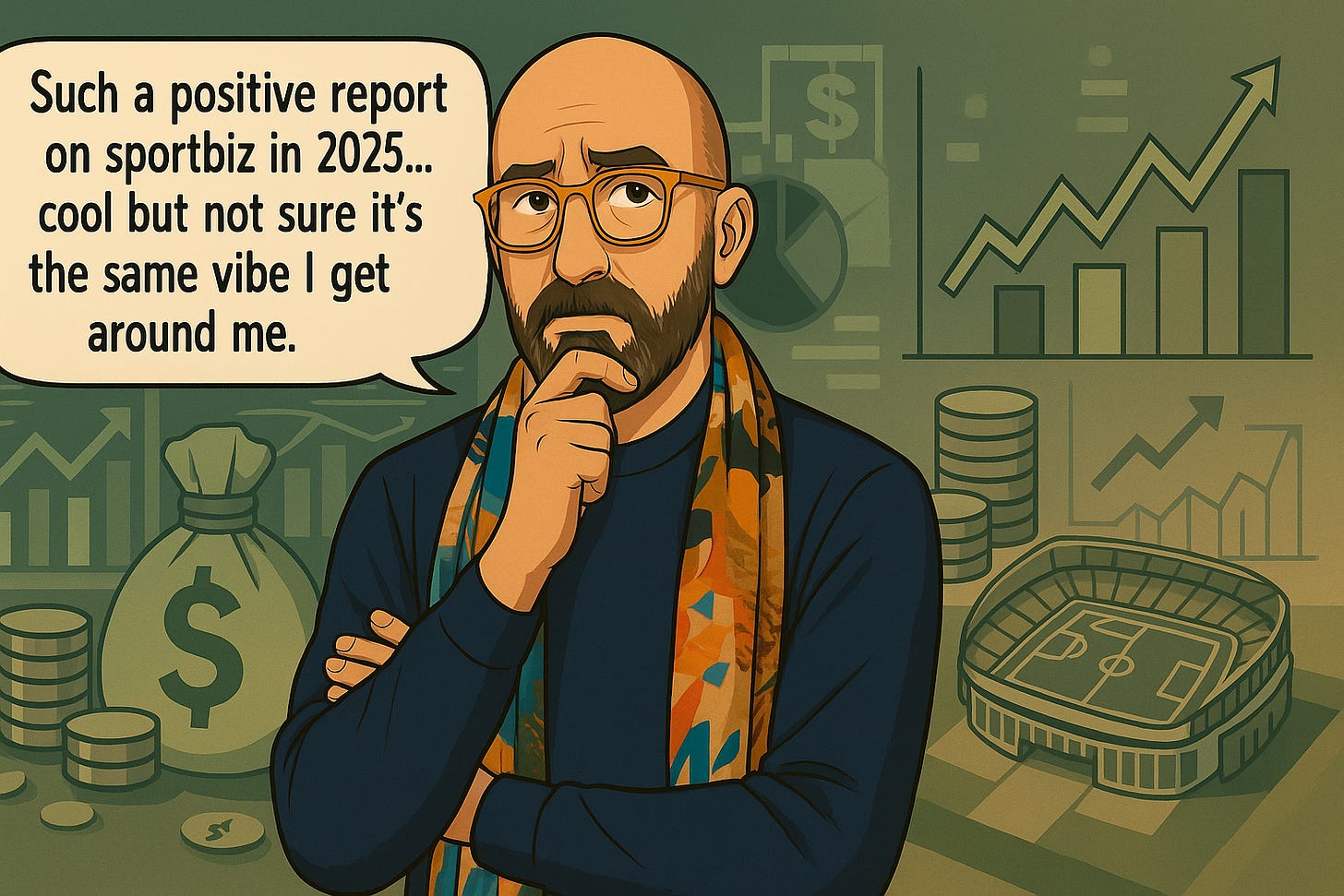

Mergers and acquisitions (M&A) reached $32.2 billion in disclosed value across 233 transactions. The figures suggest not only consistency with late 2024 levels but a renewed push toward platform consolidation.

Some of the biggest moves included:

TSG Consumer acquiring EōS Fitness for $1.5B, expanding its hold in the high-volume wellness segment.

Disney taking a 70% stake in FuboTV and merging it with Hulu + Live TV, creating North America’s second-largest digital pay-TV player and resolving antitrust issues with the collapsed Venu Sports venture.

RTL Group snapping up Sky Deutschland for $613M, building a DACH-region streaming and TV powerhouse.

IMG Academy acquiring SportsRecruits, bolstering its recruiting and education ecosystem.

The narrative is clear: media and fitness platforms are not just buying audience or tech—they're buying infrastructure for recurring engagement and operational scale.

2. The Youth Sports Surge: Where the Future Competes

Youth sports is no longer just a community-level afterthought. It's a $40B market, rapidly professionalizing through digital infrastructure. This segment saw a flurry of activity in H1:

Playmetrics was acquired by Genstar Capital and merged with Stack Sports, creating a juggernaut in team management.

Rocket Youth raised $100M+ to support national expansion.

Unrivaled Sports secured $120M from backers like Dick’s Sporting Goods.

On3 acquired Rivals.com from Yahoo.

Youth sports, much like esports a few years ago, is shifting from an opaque, fragmented space into a structured, monetizable industry with data, CRM, media rights, and scalable software at its core.

3. Private Capital Roars: Record Fundraising Fuels Growth

The private financing boom was perhaps the clearest sign that investors believe the sports industry is not just growing—it's institutionalizing. H1 2025 saw $6.6B raised in 239 deals, the largest half-year total ever.

The top deals reflect confidence in media, fan engagement, and platformization:

Infinite Reality (Napster): $3B to scale its digital studio and metaverse infrastructure.

DAZN: $1.8B including a $1B investment from Saudi Arabia’s PIF via SURJ Sports.

Teamworks: $235M to fuel AI and data expansion in athlete performance software.

Interestingly, over 80% of these deals were still early stage. But the presence of unicorns and mega-rounds signals a bifurcated market: early innovation is alive and well, but so is a deep-pocketed push for market dominance.

4. Investor Appetite: New Funds, New Frontiers

The long-term capital pool is growing just as fast. Over $3.5B in sports-specific funds were launched in H1:

Checketts Sports / Cynosure: $1.2B for sports franchises, venues, and media.

Halo Experience Fund (Ryan Smith + Accel): $1B aimed at "experience economy" startups.

Harbinger Sports (Mark Cuban): $750M for minority stakes in U.S. pro teams.

TPG & Symphony Ventures: With Rory McIlroy, targeting sports IP.

Ariel Investments: Focused fund on women’s sports franchises.

The rise of specialized vehicles reflects a maturation of the sports investment thesis. No longer a side bet, sports assets are being integrated into serious long-term portfolio strategies.

5. Hot Segments: Where Capital and Strategy Meet

Across M&A and VC, certain verticals continue to draw outsized attention:

Fan Engagement & Experience: Platforms offering community tools, personalization, and gamification.

Performance Analytics: AI-powered training, wearable tech, and unified data stacks.

Ticketing & Venue Ops: SaaS tools that optimize operations for clubs, leagues, and venues.

Fantasy, Esports, and Betting: With Flutter, DraftKings, and newer players like Underdog gaining traction.

Women’s and Emerging Leagues: Seen as undervalued with high growth potential.

These segments aren’t just "nice to have" features anymore. They are becoming core pillars of the modern sports tech stack.

6. Public Markets: A Quiet Rally for Sports Tech Stocks

While IPOs remained cautious, public sports tech companies outperformed broader indices:

Digital Media & OTT: +25.8% YTD

Sports Franchises: +20.7%

Esports/Fantasy/Betting: +20.6%

This performance, combined with strong EBITDA growth in subsectors like performance analytics, is encouraging more IPO-ready companies to quietly prep for listing in late 2025 and beyond.

Sports Tech is Now a System, Not a Sector

What H1 2025 made abundantly clear is that sports tech is no longer a collection of startups looking for product-market fit. It has become an ecosystem with its own M&A logic, financial institutions, operational benchmarks, and innovation cycles.

The digital transformation of sport isn't ahead of us—it's now. And every deal, from a youth sports CRM startup to a $3B fundraise, is a stitch in the fabric of a more connected, competitive, and capital-rich global industry.

The game has changed. And it’s only halftime.

Mapping the Sports Tech Ecosystem in 2025: Expanded Segment Analysis

A layered, realistic view of the evolving landscape, sector by sector

A Living, Breathing Market Map

The sports tech world in 2025 is no longer easily categorized. It doesn’t behave like a siloed industry. It acts like an operating system—constantly updating, integrating, and converging. While market maps like the one created by Drake Star provide a much-needed visual anchor, understanding the ecosystem requires more than just grouping logos. Each segment is evolving on its own terms, with unique opportunities, challenges, and trajectories. Below, we blend strategic function with current reality—offering a factual, nuanced vibe check on each layer of the ecosystem.

1. Rights Owners

Role: Leagues, federations, and IP holders are the wellspring of value—licensing access to content, data, and branding.

Players: NBA, FIFA, IOC, Premier League, LaLiga

Vibe 2025: Rights holders are becoming more than licensors. The NBA, for example, is exploring expansion and inking long-term media deals while others (FIFA, IOC) experiment with digital-first strategies. However, the jump into DTC platforms or club ownership (as seen with US investors in Europe) is costly and complex. The tension lies in the ambition to control everything versus the risk of overreach and margin dilution.

Keep reading with a 7-day free trial

Subscribe to A guy with a scarf to keep reading this post and get 7 days of free access to the full post archives.